Is Indian Gaming Sector at the Inflection Point?

October 12, 2018

India is the world’s second-largest smartphone market after China, with an anticipated 308.3 million users in 2018. It was a hot market which big tech mammoths like Amazon, Alibaba, Facebook, Uber, SoftBank, etc. swarmed into. It was also a place where huge challenges looming ahead.

Rockshake’s Director of International Business and Strategy in India, Harry Bajaj recently hosted a panel discussion at the 3rd Chindia TMT Dialogue event, and gave a closely-observed update on India mobile game market.

The market is huge and has potential, as everyone agrees. Boston Consulting Group (BCG) estimates India will have over 850 million internet users by 2025, more than the combined populations of the G7 countries. Half of them will be from rural areas and 40% will be female.

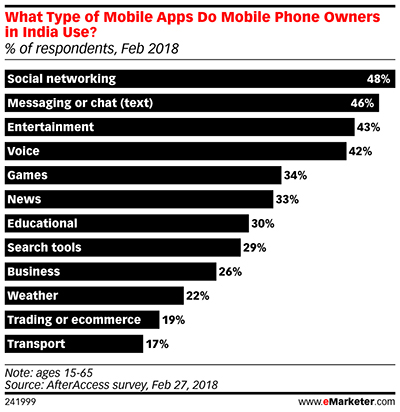

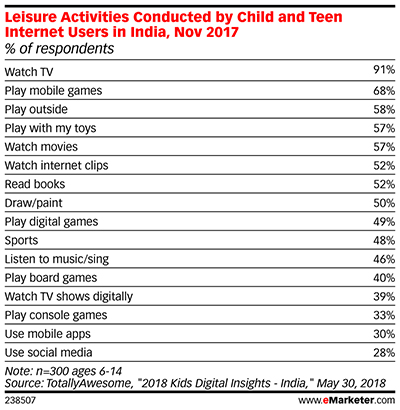

Smartphone users are slowly picking up mobile games as their leisure activity and means to kill time. However, as Harry analyzed, comparing to Chinese market, Indian gaming market is less evolved, DAUs and MAUs are relatively low. A large portion of gamer population come from gambling and lottery category, while others like Fantasy, action games picking up rather slowly.

Harry also said that loyalty of Indian gamers has not been established. They do not stick to a specific game or even game category, but rather move around depending on new introductions in the space. This makes it difficult for the game developers to retain the attention of users long term, until unless the game is very much attractive and/or addictive. User retention would be a tricky task here.

Another shackle of further development on mobile gaming section is multilingualism in India. Speakers of Hindi and other local languages will drive the next phase of internet adoption in India. This audience will be more than 2.5 times the size of the English language user base by 2021, according to a Google and KPMG report.

For foreign companies and even Indian developers based in different area, they will all face the problem. Currently, mobile gaming in India has not yet become an arena of foreign developers and their local counterparts, but as the technology infiltrates further, the language issue will emerge and become a huge obstacle for foreign players.

So does it mean game developers from outside India are excluded from the massive market? Not necessarily. As what Rockshake has proved in the market, players in the market is still trying to understand what is working well and not. There is quite a risk of imbalance between users and revenue. With in-app purchases that are not very high, game developers lean toward in-app ads to maintain some balance between the users and revenue. As the market grows larger, in-app ads could bring relatively steady cash flow for developers. Harry believed this is quite a way for foreign developers to gradually nurture the market, take a leap forward when the market accumulates its strength and a step ahead of other competitors.

For more information and business inquiries concerning Indian mobile game market, welcome to contact us at india@rock-shake.com.